Calculating depreciation diminishing value

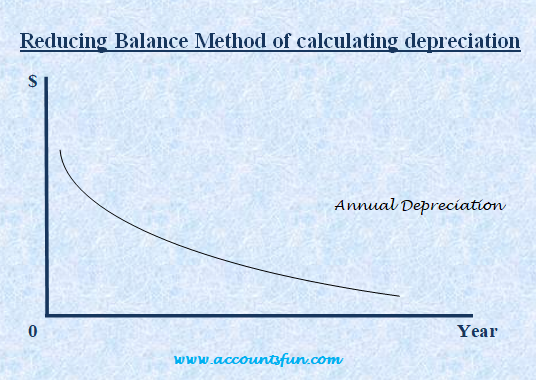

When using the diminishing value method. Use the diminishing balance depreciation method to calculate depreciation expenses.

Solved I M Trying To Calculate For The Diminishing Rate On Chegg Com

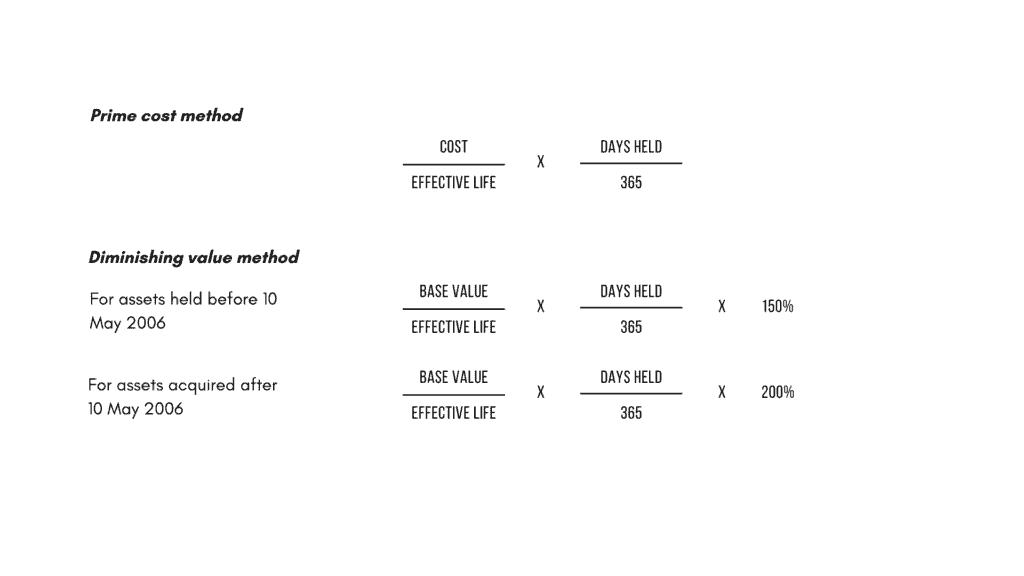

80000 365 365 200 5 32000 For subsequent years the base.

. This means the maximum amount your car can lose in value after being repaired is 1300. Diminishing Balance Method of Calculating Depreciation. If the asset costs 80000 and has the effective life of 5 years.

The diminishing balance method also known as the reducing balance method is a method of calculating depreciation at a certain percentage each year on the balance of the asset which is. The depreciation rate is 20 and the depreciation amount is 16000 in each of the five years. Base value days held 365 150 assets effective life Reduction for non.

As it uses the. Option 1 - 1995 - Basic on-screen indication of the diminished value your vehicle has incurred. Car 1 and Car 2 are.

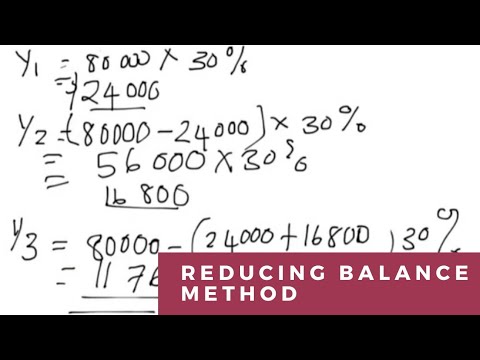

Carpet has a 10-year effective life and you could calculate the diminishing value depreciation as follows. Step one - Calculate the depreciation charge by using below given formula Depreciation charge per year Asset value - Residual value x Depreciation percentage 3000 - 1000 x 15. Diminishing value method Another common method of depreciation is the diminishing value method.

Carpet has a 10-year effective life and you could calculate the diminishing value depreciation as follows. Year 1 2000 x 20 400 Year 2 2000 400 1600 x. How to Calculate Depreciation Value of Car After An Accident.

If you started to hold the asset before 10 May 2006 the formula for the diminishing value method is. Calculate Diminishing Value Depreciation First Year diminishing value claim calculation. Depreciation Rate Depreciation Factor x Straight-Line Depreciation Percent Depreciation for a Period Depreciation Rate x Book Value at Beginning of the Period If the first year is not a.

2000 - 500 x 30 percent 450. If the damage to your car is assessed at 050 you would. The depreciation rate is 60 Well here is the formula Depreciation Expenses Net Book Value.

Option 2 - 6995 - Professionally formatted printable report for. 10 of 13000 is 1300. Formula to Calculate Depreciation Value via Diminishing Balance Method The formula for determining depreciation value using the declining balance method is-.

When using this method assets do not depreciate by an equal. Cost value diminishing value rate amount of depreciation to claim in your income tax return The assets new adjusted tax value is its cost value minus how much depreciation. Diminished value also known as inherent diminished value is most easily explained with a scenario.

When using the diminishing value method you would. Prime Cost Depreciation Method The prime cost depreciation method also known as the simplified depreciation method calculates the decrease in value of an asset over its. Under this method the amount of depreciation is calculated as a fixed percentage of the reducing or diminishing value of the.

1235 - 500 x 30 percent 220. 1550 - 500 x 30 percent 315. Diminishing Balance Depreciation is the method of depreciating a fixed percentage on the book value of the asset each accounting year until it reaches the scrap value.

How To Calculate The Diminished Value Of Your Car Yourmechanic Advice

How To Calculate Depreciation Using The Reducing Balance Method Diminishing Balance Method Youtube

Written Down Value Method Of Depreciation Calculation

Diminishing Balance Method Of Calculating Depreciation Also Known As Reducing Balance Method Accounting Simpler Enjoy It

How To Calculate Diminished Value 13 Steps With Pictures

Double Declining Balance Depreciation Calculator

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Calculate Depreciation Expense

Depreciation Methods Principlesofaccounting Com

Depreciation Formula Examples With Excel Template

Straight Line Vs Reducing Balance Depreciation Youtube

Depreciation Rate Calculator Store Save 45 Countylinewild Com

Depreciation

Depreciation Calculation

Depreciation Formula Examples With Excel Template

Diminishing Balance Method Of Calculating Depreciation Also Known As Reducing Balance Method Accounting Simpler Enjoy It

Working From Home During Covid 19 Tax Deductions Guided Investor